SUMMARY

As home-based Bitcoin mining gains popularity, users are seeking machines that balance performance, efficiency, and noise control. The Fluminer T3 aims to meet this demand. This article reviews its features, compares it with other home ASICs, evaluates its profitability, and explores its long-term potential for residential miners.

Technical Specifications

| Manufacturer | Fluminer |

|---|---|

| Model | T3 |

| Release | Sep 2025 |

| Size | 450 x 140 x 300mm |

| Weight | 12600g |

| Noise level | 50dB |

| Power | 1700W |

| Voltage | 110-240V |

| Interface | Ethernet |

| Temperature | 5 – 45 °C |

| Humidity | 5 – 95 % |

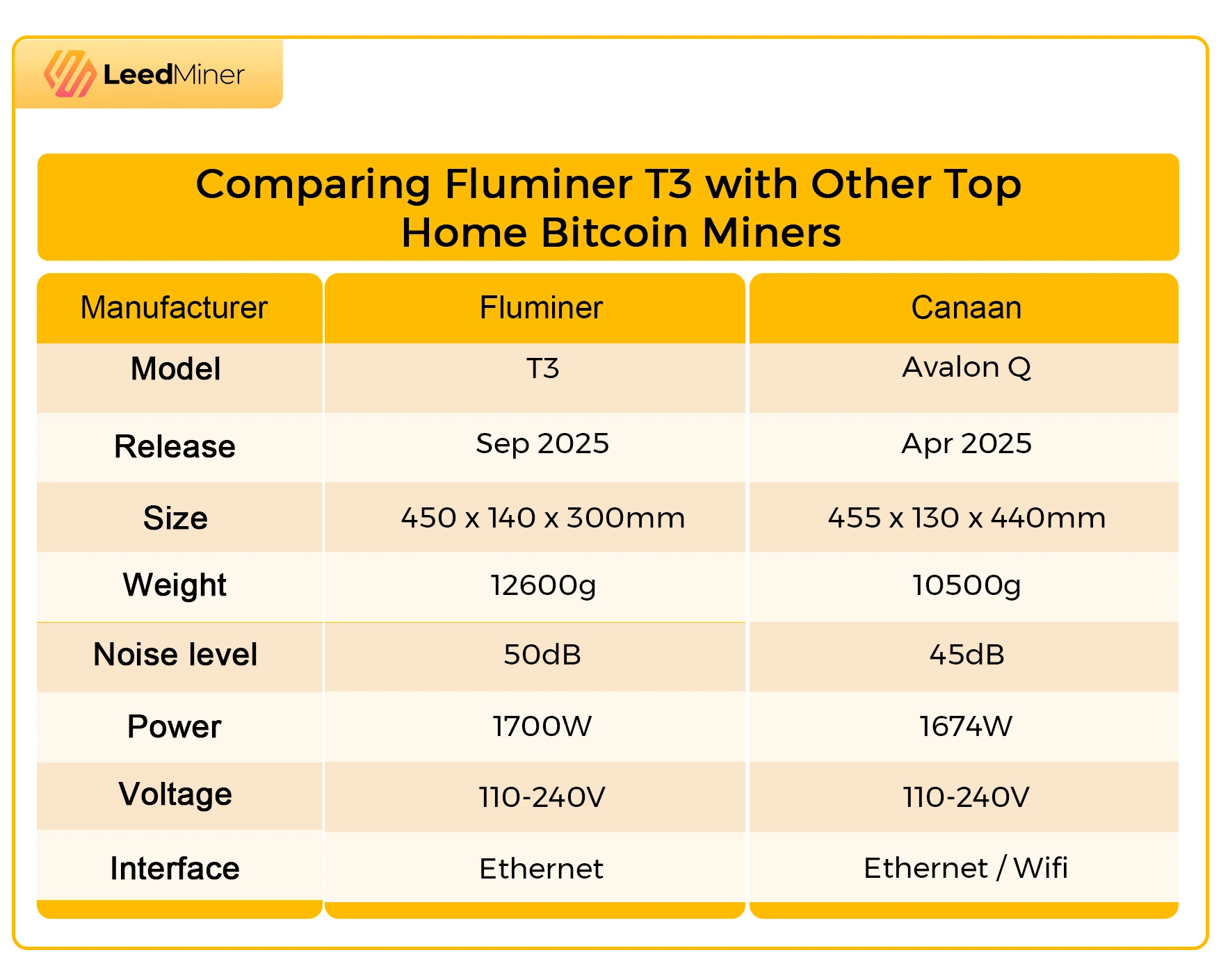

Comparing Fluminer T3 with Other Top Home Bitcoin Miners

Size and Build

The Fluminer T3 comes in a more compact and vertically oriented design (450 x 140 x 300 mm), making it easier to fit into bookshelves or home office spaces. The Avalon Q, while slightly slimmer in width, is notably deeper at 440 mm. This extra depth may limit placement options in smaller environments. Additionally, the T3 is heavier at 12.6 kg compared to Avalon Q’s 10.5 kg, indicating a sturdier build but possibly more demanding for placement or transport.

Noise and Cooling

Noise is a decisive factor for home miners. The Avalon Q has a slight edge here, operating at a low 45 dB thanks to its dual-fan setup and noise optimization. The Fluminer T3 follows closely behind at 50 dB, which is still exceptionally quiet by mining standards. Both miners can run unobtrusively in a living space without disrupting daily life, but those sensitive to sound may appreciate Avalon Q’s marginal advantage.

Power and Efficiency

In terms of power consumption, both miners are nearly identical—1674W for Avalon Q and 1700W for T3. While the wattage is close, real-world efficiency may differ depending on chip architecture and heat dissipation. Avalon Q utilizes 4nm chips, a clear indicator of energy efficiency and modern fabrication, although specific hashrate and J/TH figures are not disclosed. The T3’s chip specs are not detailed, so direct efficiency comparisons will rely on live testing once the T3 is released.

Connectivity and Convenience

Avalon Q supports both Ethernet and WiFi connections, offering more flexibility in home networking setups—ideal for users who want to avoid running cables across their home. Fluminer T3, on the other hand, is Ethernet-only, which may require more thoughtful router placement or the use of Ethernet-over-powerline adapters.

Other Considerations

Both models are designed for wide environmental tolerance, operating within 5–45°C and 5–95% humidity, making them suitable for most indoor climates. Voltage support is also identical (110–240V), ensuring compatibility across global power standards.

Verdict

Fluminer T3 and Avalon Q represent two different takes on home-friendly Bitcoin mining. The Avalon Q leans slightly more toward silent, energy-efficient operation with modern chip design and WiFi support. Meanwhile, the Fluminer T3 emphasizes physical compactness and durability, potentially making it more adaptable in tight spaces.

For users prioritizing ease of setup, silent running, and network flexibility, the Avalon Q might be the better pick. But if compactness and build quality take precedence, the Fluminer T3 could become the new favorite when it officially hits the market.

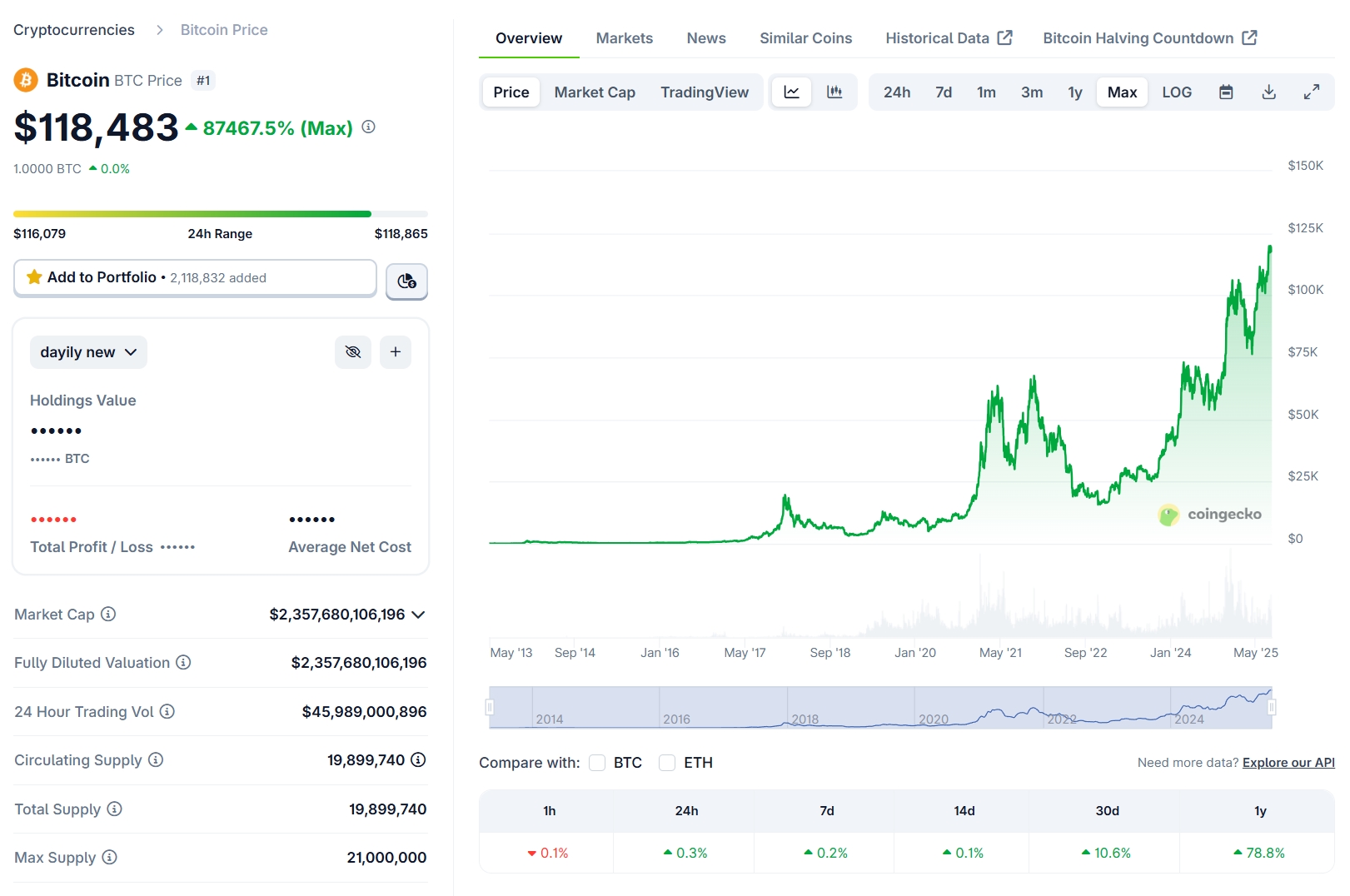

Bitcoin Coin Prices History

Let’s take a look at the current market status of Bitcoin(BTC) — the coin mined by this machine — to better understand the profitability and market potential.

Bitcoin Market Snapshot (As of June 31, 2025)

| Metric | Value |

|---|---|

| Current Price | $118,483 |

| All-Time High (ATH) / Low (ATL) | $122,838 / $67.81 |

| Market Capitalization | $2,357,680,106,196 |

| Fully Diluted Valuation (FDV) | $2,357,680,106,196 |

| Market Rank | #1 |

| Circulating Supply | 19,899,740 |

Bitcoin Price Trend

Bitcoin (BTC), the largest cryptocurrency by market capitalization, continues to show strong market presence, though with signs of short-term consolidation. In the past 24 hours, BTC recorded a trading volume of $45.98 billion, marking a 20.80% increase from the previous day. This surge in volume suggests a recent uptick in market activity, possibly driven by institutional movement or macroeconomic factors.

Currently, Bitcoin is trading just 3.54% below its all-time high of $122,838, reinforcing its strong upward trend in recent months. Compared to its all-time low of $67.81, BTC has risen an astonishing 174,640%, reflecting its long-term growth and adoption trajectory.

The market capitalization of Bitcoin now stands at approximately $2.36 trillion, cementing its position as the most valuable digital asset globally. Its fully diluted valuation (FDV) mirrors this figure, assuming the full 21 million BTC supply were already in circulation.

However, when comparing Bitcoin’s recent price performance to the broader crypto market, BTC has slightly underperformed. Over the past 7 days, BTC posted a modest gain of 0.20%, while the overall crypto market rose by 0.60%. This suggests capital may be rotating into altcoins or newer narratives in the space.

In summary, Bitcoin maintains a strong long-term price trend and market dominance, though near-term performance indicates a pause in momentum relative to the broader market.

Fluminer T3 Profitability Analysis (at $0.07/kWh)

Income and Electricity Costs

| Period | Income | Electricity (@ $0.07/kWh) | Net Profit |

|---|---|---|---|

| Daily | $6.79 | -$2.86 | $3.94 |

| Monthly | $203.79 | -$85.68 | $118.11 |

| Yearly | $2,479.41 | -$1,042.44 | $1,436.97 |

- Electricity accounts for about 42% of daily income.

- With annual profits over $1,400, if the machine is priced around $1,500–$2,000, the estimated payback period is roughly 12 to 17 months, assuming stable network difficulty and BTC price.

Solo Mining Probability

| Period | Chance of Finding a Block |

|---|---|

| Daily | 1 in 55,200 days |

| Monthly | 1 in 1,800 months |

| Yearly | 1 in 152 years |

- The current block reward is approximately 3.17 BTC.

- Given the low odds, solo mining with Fluminer T3 is not practical. Pool mining is strongly recommended for consistent earnings.

At an electricity rate of $0.07/kWh:

- Fluminer T3 stands out as one of the most profitable home-friendly BTC miners available.

- Its low noise level (50 dB), moderate power consumption (1700W), and manageable electricity costs make it ideal for residential environments.

- For users seeking a quiet, energy-efficient, and profitable home mining setup, the Fluminer T3 is a compelling option.

Let me know if you’d like a version tailored to a different electricity rate or translated into a blog-ready format.

Future Perspective of Fluminer T3

Fluminer T3 is well-positioned for the growing trend of home-based Bitcoin mining. With its low noise, compact size, and standard power compatibility, it stands out in a market where most miners are built for industrial farms.

As electricity costs and regulations become more important, T3’s 1700W power draw offers better long-term sustainability compared to higher-power models. Its quiet operation (50 dB) also makes it ideal for residential use, especially in regions sensitive to noise and heat.

Looking ahead, if Bitcoin’s price continues to rise and decentralized mining gains momentum, the T3 could remain relevant for years. While future halving events will lower rewards, the T3’s energy efficiency gives it a better chance of staying profitable in the long term.

In short, Fluminer T3 isn’t just about current returns—it’s a forward-looking choice for those who want to mine at home reliably and quietly.