SUMMARY

As the demand for zero-knowledge proof and privacy-focused blockchain solutions continues to grow, ALEO mining has quickly become a hotspot for crypto miners seeking early-mover advantage. Among the emerging hardware options, the Goldshell AE Max II stands out with its high-performance specs and solid brand reputation. But how does it really perform in the current ALEO ecosystem?

In this detailed review, we’ll dive into the AE Max II’s specifications, profitability, efficiency, and how it stacks up against top competitors like IceRiver AE2 and AE1 Lite — helping you decide whether it’s the right choice for your next mining investment.

Technical Specifications

| Manufacturer | Goldshell |

|---|---|

| Model | AE Max II |

| Also known as | Goldshell AE-Max 2 |

| Release | Aug 2025 |

| Size | 264 x 200 x 290mm |

| Weight | 12450g |

| Noise level | 85dB |

| Fan(s) | 2 |

| Power | 3200W |

| Voltage | 185-285V 16A |

| Interface | Ethernet |

| Temperature | 5 – 45 °C |

| Humidity | 5 – 95 % |

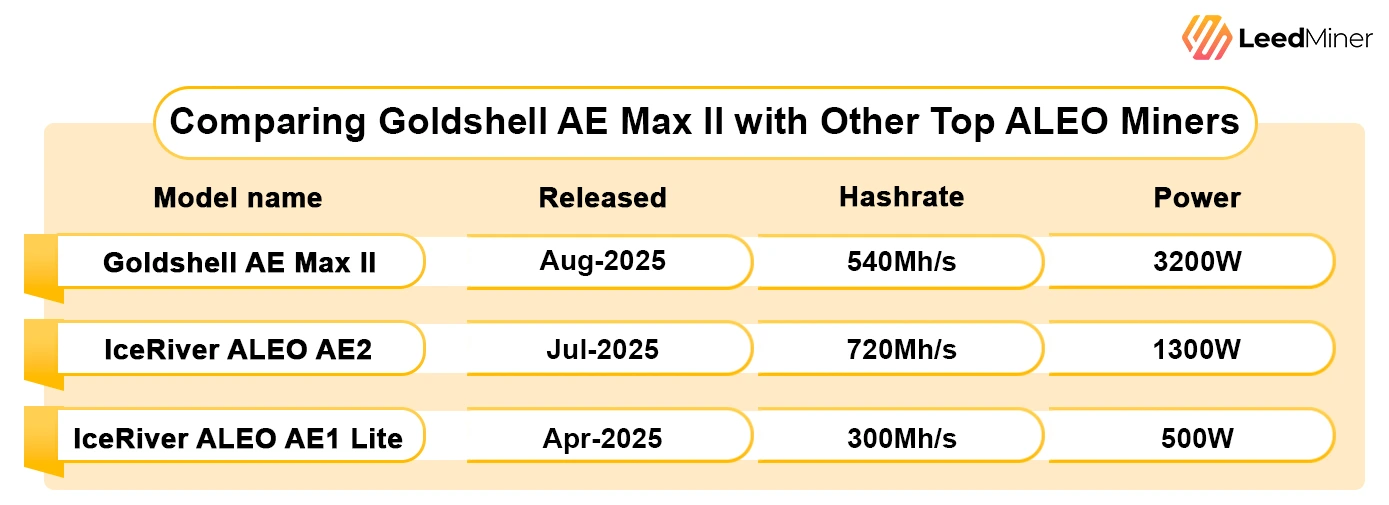

Comparing Goldshell AE Max II with Other Top ALEO Miners

When evaluating the performance and efficiency of ALEO miners, Goldshell AE Max II stands out with a respectable 540 Mh/s hash rate. But how does it fare against its key competitors — the IceRiver ALEO AE2 and the IceRiver ALEO AE1 Lite?

1. Hashrate Comparison

- Goldshell AE Max II delivers 540 Mh/s, which places it between the AE2 and AE1 Lite.

- IceRiver AE2 leads the pack with 720 Mh/s, around 33% more than AE Max II.

- IceRiver AE1 Lite offers just 300 Mh/s, nearly 45% less than AE Max II.

From a raw hashrate perspective, Goldshell’s offering provides a solid middle-ground — suitable for those who want strong performance without the power demands of AE2.

2. Power Consumption & Efficiency

- Goldshell AE Max II consumes a hefty 3200W, giving it a power efficiency of 5.93 W/Mh.

- IceRiver AE2 requires 1300W for 720 Mh/s — an efficiency of 1.81 W/Mh, making it the clear winner in energy performance.

- IceRiver AE1 Lite runs at 500W for 300 Mh/s — 1.67 W/Mh, surprisingly more efficient than both AE2 and AE Max II.

Verdict: While Goldshell AE Max II offers decent power, its high electricity consumption makes it less efficient compared to IceRiver models — especially AE1 Lite, which excels in low-power scenarios.

3. Launch Dates and Availability

- IceRiver AE1 Lite hit the market first in April 2025, followed by AE2 in July 2025.

- Goldshell AE Max II is slated for August 2025, making it the most recent addition.

This release timing might suggest that Goldshell has aimed to push performance limits — but the efficiency trade-off raises questions for long-term operations under high electricity costs.

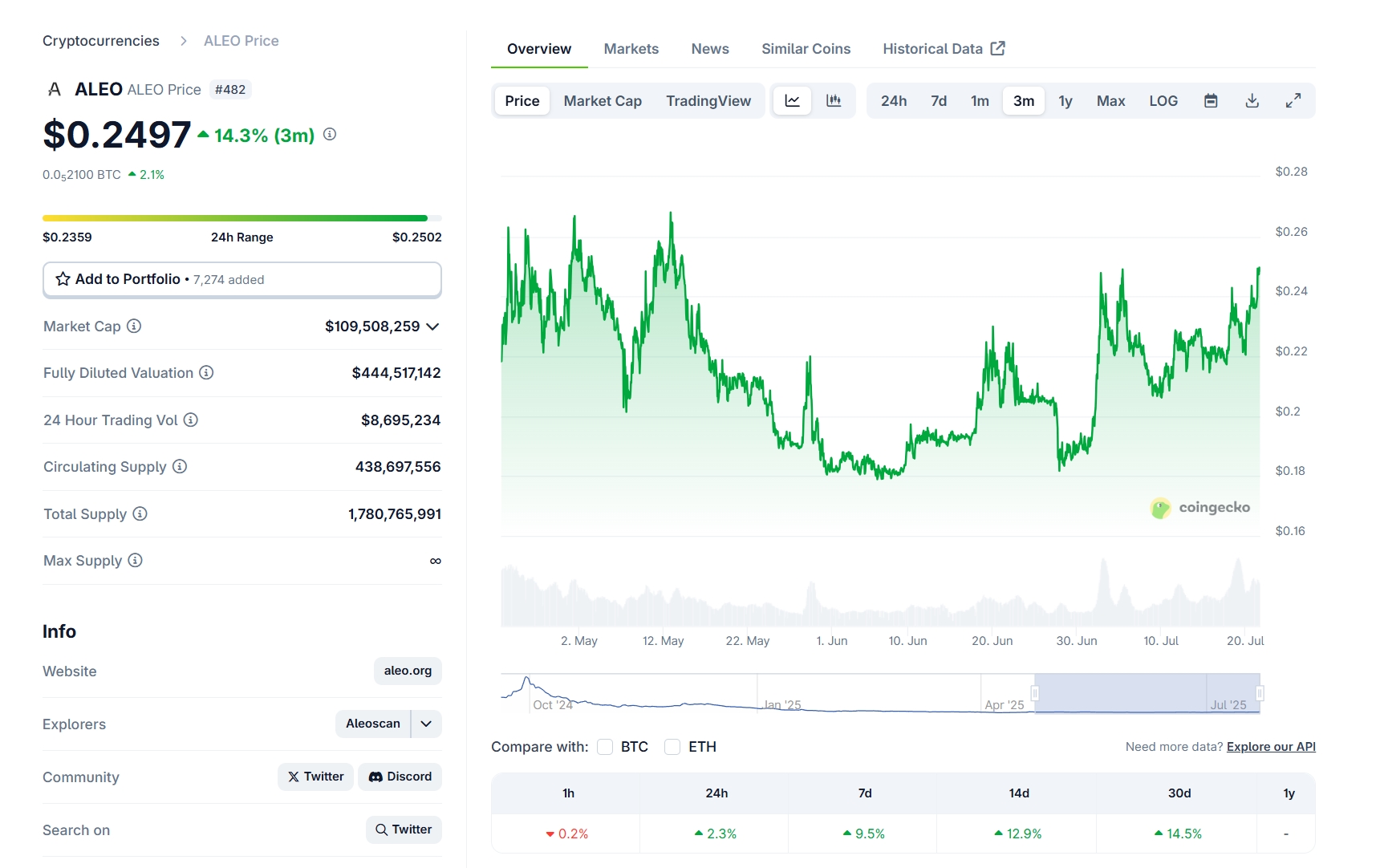

ALEO Prices History

Let’s review the current market state of ALEO—the asset mined by the Goldshell AE Max II.

ALEO Market Snapshot (As of June 21, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.2497 |

| 24H Trading Volume | $8,695,234 |

| Price Change (24H) | +2.2% |

| All-Time High (ATH) / Low (ATL) | $6.72 / $0.1129 |

| Market Capitalization | $109,508,259 |

| Fully Diluted Valuation (FDV) | $444,517,142 |

| Market Rank | #482 |

| Circulating Supply | 438,697,556 |

ALEO Price Trend

In the last 24 hours, ALEO (ALEO) recorded a trading volume of $9,224,120, marking a 4.60% decline compared to the previous day — a signal of cooling market activity. Despite the short-term dip, ALEO has shown notable weekly resilience with a 9.50% price increase over the past 7 days, outperforming both the global crypto market (up 5.30%) and the Smart Contract Platform sector (up 5.20%).

Historically, ALEO reached an all-time high (ATH) of $6.72, but it is now trading approximately 96.30% below that peak. On the flip side, its current price stands 120.37% above its all-time low of $0.1129, indicating a recovery from previous lows.

As of now, ALEO holds a market capitalization of $109,344,471, placing it at #483 on CoinGecko’s ranking. With 440 million tokens in circulation, the token’s current market cap reflects only a portion of its potential. If all 1.8 billion ALEO tokens were in circulation, the fully diluted valuation (FDV) would rise to $443,852,292.

ALEO’s recent momentum suggests growing investor interest, though its relatively low market cap still positions it as a high-risk, high-reward asset within the smart contract ecosystem.

Goldshell AE Max II Profitability

The Goldshell AE Max II produces a hashrate of 540 Mh/s with a power consumption of 3200W, equating to an energy efficiency of 5.926 J/Mh. Based on current ALEO mining economics and an electricity rate of $0.07/kWh, here’s a breakdown of its daily financials:

- Daily Income: $22.09

- Electricity Cost: -$5.38

- Net Profit: $16.71

Despite not being the most power-efficient miner on the market, AE Max II remains a strong earner thanks to its high hashrate. Over longer periods, this translates into:

- ~$501 monthly profit

- ~$6,100 annual profit

This profitability makes the AE Max II a viable choice for ALEO miners looking for daily yield, especially in locations with moderate electricity costs.

Future Perspective of Goldshell AE Max II

Looking ahead, the Goldshell AE Max II sits in an interesting position within the ALEO mining landscape. With a solid hashrate of 540 Mh/s and a net daily profit of $16.71, it currently offers attractive returns. However, its high power consumption (3200W) and moderate efficiency (5.926 J/Mh) may become a concern as the network grows and competition intensifies.

Key Considerations for the Future:

- Increasing Network Difficulty: As more miners join the ALEO network, mining difficulty is expected to rise. This will likely reduce the daily rewards, putting pressure on less efficient machines like the AE Max II.

- Electricity Prices Volatility: With a large power draw, the AE Max II’s profitability is highly sensitive to energy prices. A minor increase in electricity cost can quickly erode margins, especially in regions with fluctuating rates.

- Next-Gen Miners Emerging: Newer ALEO miners such as IceRiver AE2 and AE1 Lite are already offering better efficiency. Should even more efficient hardware enter the market, the AE Max II might gradually become obsolete or require relocation to low-cost energy zones.

- Resale & Secondary Market Viability: Goldshell’s brand reputation and build quality may help sustain resale value, which could soften long-term depreciation risks — especially if ALEO maintains momentum as a leading privacy smart contract platform.

Overall Outlook:

The AE Max II is currently a profitable and reliable miner, but its long-term viability hinges on how quickly mining difficulty increases and hardware innovation evolves. For miners seeking short- to mid-term ROI, it remains a reasonable investment, especially when paired with affordable electricity and stable infrastructure.